Dubai’s rental market has been on an upward trajectory in recent years, defying global economic uncertainties and demonstrating remarkable resilience. The third quarter of 2023 saw a continuation of this growth trend, with PropertyFinder, a leading online real estate portal in the region, and the Dubai Land Department (DLD) reporting a surge in transactions and a significant increase in demand.

This positive momentum is attributed to a combination of factors, including Dubai’s position as a global hub for business, tourism, and investment, as well as its pro-investor policies and attractive lifestyle offerings.

Table of Contents

- Rental Market Transaction Triumphs

- Value Surge

- Demand Dynamo in Dubai

- Top Communities and Nationalities

- Supply Challenges Amidst Launches

- Notable Off-Plan Launches

- Luxury Living’s Ascension

- Navigating Dubai’s Rental Market Landscape: Landlord Power and Leasing Trends

- Unveiling the Power Players

- Dubai’s Rental Market Enduring Appeal

- Key Takeaways

Rental Market Transaction Triumphs

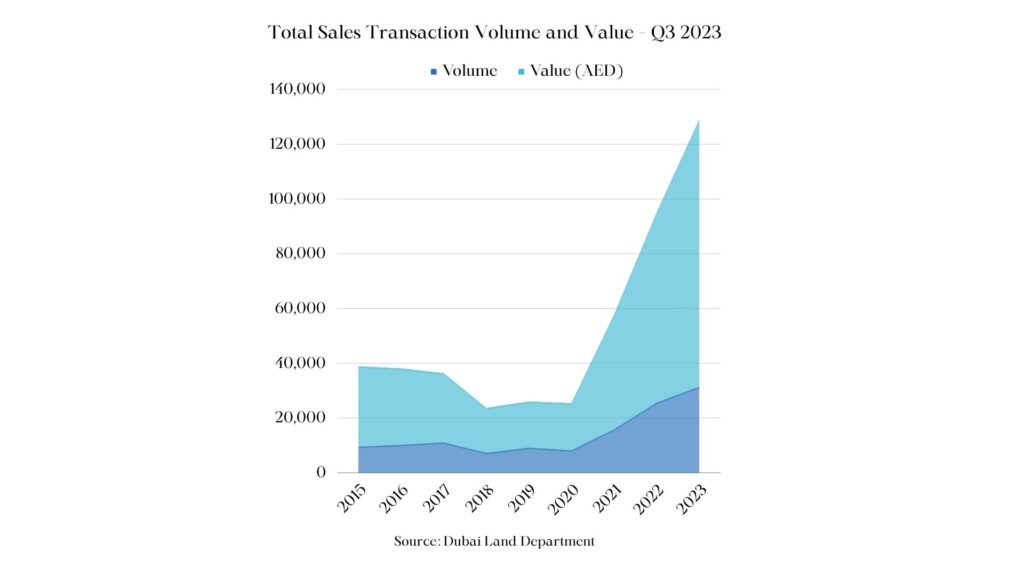

Dubai’s rental market witnessed a surge in activity, with 28,249 transactions recorded in Q3, representing a 4% increase from the previous quarter and an impressive 23% growth from 2022. Villas and townhouses led the charge, with sales soaring by 34%, while apartments faced a modest 4% decline. The secondary market for villas also performed well, with a notable 38% uptick.

Value Surge

The value of properties sold in Q3 reached a staggering AED 79.3 billion, marking a 13% increase from Q2 and an impressive 49% jump from Q3 2022. This surge was driven by a 54% increase in the value of villa and townhouse sales, while apartment sales experienced a 15% decrease. The secondary market remained a key factor, accounting for over 80% of the villa market and witnessing a substantial 48% boost in off-plan villa transactions.

Demand Dynamo in Dubai

The DLD observed a significant increase in demand, with leads surging by 119% year-on-year. Rising rents and a desire for stability in Dubai fueled this demand. End-users played a more prominent role, accounting for 52% of buyers compared to 45% previously. Notably, mortgage demand remained resilient, with finance buyers constituting 44% of all transactions despite higher interest rates.

Top Communities and Nationalities

Dubai’s allure remains global, attracting a diverse clientele. The top three communities in demand for apartments were Dubai Marina, JLT, and Downtown Dubai, while JVC, Damac Hills, and Reem led in villas and townhouses. Indian and British nationals dominated the buyer pool, while Russians slipped out of the top three for the first time since Q2 2022.

Supply Challenges Amidst Launches

Developers responded to the demand surge by launching new off-plan projects in Q3. However, these properties are not expected to be completed until 2025 or later, limiting their immediate impact on the market.

Notable Off-Plan Launches

- Dubai Properties: Madinat Jumeirah Living – Elara (Apartment)

- Emaar: The Oasis – Palmiera (Villa), Emaar Beachfront – Bayview 2 (Apartment), Dubai Hills Estate – Greenside Residence (Apartment), Mina Rashid – Clearpoint (Apartment), The Valley – Nima (Townhouse)

- Expo City: Expo Valley – Shams Townhouses (Townhouse)

- Meraas: Central Park – Central Park Plaza (Townhouse & Apartment)

- Nakheel: Palm Jebel Ali – Palm Jebel Ali Villas (Villa)

Own a piece of paradise with our exclusive villas at Palm Jebel Ali. Nestled amidst pristine beaches and lush greenery, these villas offer an unparalleled lifestyle of luxury and tranquility. Contact us today to learn more about this exceptional opportunity.

Luxury Living’s Ascension

The luxury market experienced a remarkable 44% increase in transactions over AED 15 million compared to Q2. This growth, driven by a 66% surge in the secondary market, is expected to continue with the influx of new millionaires in the UAE.

Navigating Dubai’s Rental Market Landscape: Landlord Power and Leasing Trends

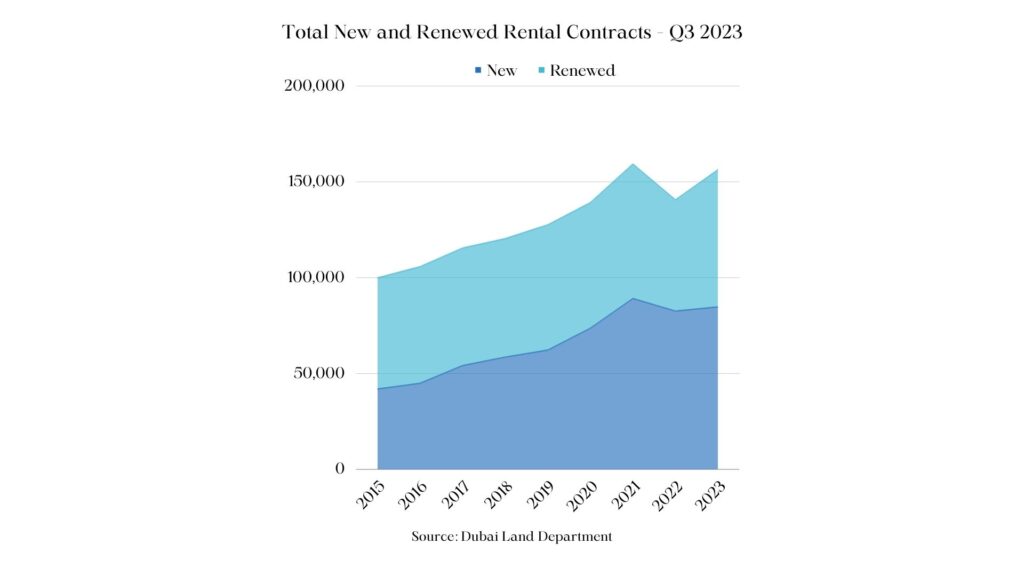

Rising rental prices prompted tenants to renew contracts, leading to a 19% drop in leasing transactions compared to Q3 2022. Occupancy rates remained high due to strong demand and limited rental availability. Landlords maintained their negotiating power, with 55% of tenants opting for one or two cheques. However, the increase in four-cheque payments, from 26% to 34%, suggests that rising prices may be influencing payment terms.

Unveiling the Power Players

Dubai’s rental market is comprised of various entities, including building management companies, top real estate companies, and property management companies. These players navigate the complexities of the market, ensuring a seamless experience for buyers and tenants.

Dubai’s Rental Market Enduring Appeal

Dubai’s rental market, as narrated by PropertyFinder and the DLD, is a testament to the city’s enduring appeal as a global property hub. As the market evolves, each transaction and trend shapes the city’s destiny, making it a sought-after destination for property enthusiasts worldwide.

Key Takeaways:

- Dubai’s rental market is experiencing strong growth, with a 23% increase in transactions from 2022.

- The value of properties sold in Q3 2023 reached AED 79.3 billion, a 49% jump from Q3 2022.

- Demand for rental properties is surging, with leads up 119% year-on-year.

- The top three communities in demand for apartments are Dubai Marina, JLT, and Downtown Dubai.

- The top three communities in demand for villas and townhouses are JVC, Damac Hills, and Reem.

- Indian and British nationals dominate the buyer pool.

- Luxury properties are seeing strong demand, with a 44% increase in transactions over AED 15 million.

- Rising rental prices are prompting tenants to renew contracts, leading to a 19% drop in leasing transactions compared to Q3 2022.

- Occupancy rates remain high due to strong demand and limited rental availability.

- Landlords are maintaining their negotiating power, with 55% of tenants opting for one or two cheques.

- Dubai’s rental market is a complex ecosystem with various players, including building management companies, top real estate companies, and property management companies.

Written by: Anastasia Makarycheva